Canada Customs Invoice 2005-2024 free printable template

Get, Create, Make and Sign

Editing fillable canada customs invoice online

How to fill out canada customs invoice form

How to fill out customs invoice all:

Who needs customs invoice all:

Video instructions and help with filling out and completing fillable canada customs invoice

Instructions and Help about indicate invoice canada blank form

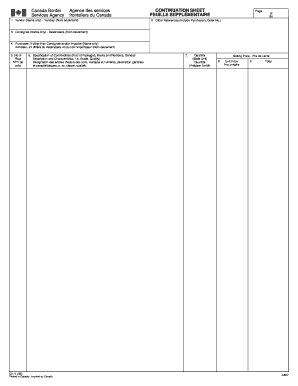

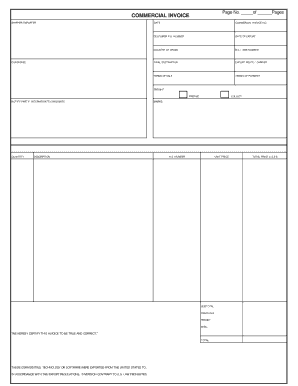

This video will guide you through the process of filling out the Canadian customs invoice form cc-1 and allow for speedy and problem-free transfer of your goods across the border into Canada Wilson has supplied this form in PDF format, so it's best opened in Adobe Acrobat Reader which is available in both PC and Macintosh formats field one is the vendor name and address this is the legal name and address of the exporter including the country the exporter resides field to is the date of direct shipment to Canada here you need to indicate the date on which the goods began their delivery to Canada box three other references is optional here you can include any useful reference such as the number of the commercial invoice or purchase order inclusion of optional information can help speed items through the border process in field for you need to indicate to consign II this is the person or company to which the goods are shipped this is the final destination it could be a customer or a vendor filled five is the purchasers name and address this box exists in instances where the destination of the goods is not the purchaser of the goods this is the purchasers name and address to whom the goods are sold if to consign II and purchaser are the same then you can indicate the same name and in brackets just indicate same address as in box for you will see a box under field four that is used to indicate whether the parties to this transaction are related or not for example the purchaser and consign II are owned or partly owned by the same company please check the appropriate box six is the country of transshipment this is a country if any through which goods were shipped in transit under customs control to Canada enter the country if the answer is none indicate so next is where the goods come from in field seven enter where the goods were grown manufactured or produced this means where the item was substantially transformed to their present form to export to Canada an important note here is for goods covered by NAFTA there are special rules so in that case you indicate the country of origin according to NAFTA guidelines there is also a special note here if the items have multiple origins you have that opportunity in box 12 to indicate the various origins per item in that case write multiple C box 12 box eight is about transportation state the mode of transportation used and the city and country which the goods began their uninterrupted journey to Canada conditions of sale and terms of payments in field nine you need to indicate the conditions of sale you can use abbreviations for example free onboard f OB is acceptable and the terms of payment in box 10 indicate the currency in which the vendors demand for payment is made Fields 11 through 17 are an itemization of the individual goods in the shipment if you have an attached commercial invoice you can check the box in field 18 and write the commercial invoice number in the space provided make sure the invoice...

Fill indicate canada customs print : Try Risk Free

People Also Ask about fillable canada customs invoice

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your canada customs invoice form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.